Editor's note: This is the second of a three-part series assessing the rebounding job market for Duke seniors. Today's article analyzes why the finance industry attracts so many recent graduates. Wednesday, The Chronicle will look at the growing trend of underutilized degrees and how Duke students are affected. Monday's article focused on the new opportunities and career paths available to graduates.

Inspired by his father’s work in investment banking, senior Garrett Lustig came to the University already attuned to finance. During his junior year, he participated in Duke’s orchestrated rounds of recruitment—donned suits, shook hands and submitted resumes. By the summer, he was clocking up to 100 hours per week at investment banking advisory firm Peter J. Solomon Company in New York City. By October, he signed a three-year contract with Centerview Partners, an investment banking and private equity firm.

After he finishes his commitment, Lustig said he might go back to graduate school, stay with the company or even switch fields entirely.

“The door’s wide open,” Lustig said. “It’s hard work, but after those years, you can literally do anything.”

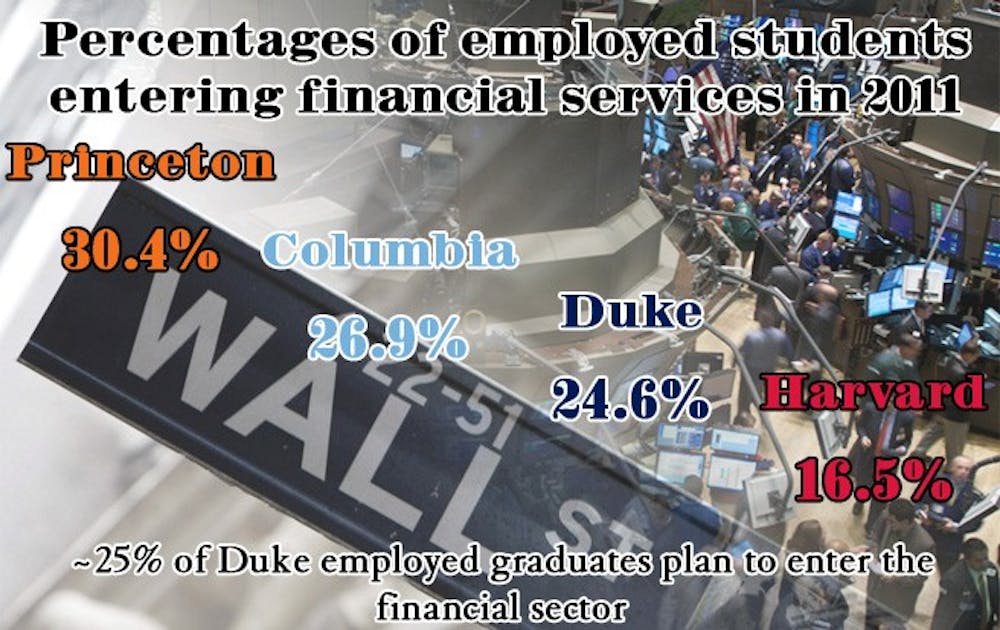

Events since the financial crisis ranging from Occupy Wall Street rallies to battles in Congress have led many Americans to question the level of influence that Wall Street wields in the economy. Despite the controversy, Duke students are still flocking to the finance industry in massive numbers. For the past five years, roughly one-quarter of Duke students who are employed by graduation reported that they have financial services jobs, which include investment banking, sales and trading, equity research and asset management.

Finance, insurance and real estate represent the largest sector of the U.S. economy, outpacing even manufacturing, according to the Bureau of Economic Analysis.

Although student interest has fluctuated year by year, interest in finance at Duke has grown since the early 2000s, said Emma Rasiel, director of the Financial Education Partnership and associate professor of the practice in economics.

Duke is not alone among the nation’s top institutions. The financial services industry tops the list at Columbia University, attracting 26.9 percent of students who found jobs in 2011. At Harvard University, the field has been the most popular among graduates for five years in a row. At Princeton University, 30.4 percent of working graduates went into finance last year.

The appeal of finance

Many students interviewed said part of the draw to finance is the lucrative compensation. Although the jobs can be intense and the hours long, some first-year analysts at investment banks can make well above $100,000 their first year, depending on year-end bonuses.

“You can make more money in Wall Street coming out of college than you can in almost any other sector,” said Kellan Dickens, Pratt ’07, who will graduate from business school at the University of North Carolina at Chapel Hill this year. “And you can enjoy that lifestyle in New York that you can’t in any other field.”

Phil Gardner, director of the Collegiate Employment Research Institute at Michigan State University, said he believes many students at elite institutions are naturally attracted to high-paying jobs as a result of their more affluent backgrounds. Almost a quarter of Duke students come from families that make more than $300,000 a year, according to self-reported senior survey data compiled by the Office of Institutional Research from 2007 to 2009.

“You’ve got a socioeconomic group at Duke that comes from the 1 percent,” Gardner said. “This group thinks, ‘We should have the freedom to make money.’ And you’re going to have a heavy dose of that mindset at Duke.”

But reducing interest in finance to simply a monetary pursuit overlooks other factors, such as gaining technical and marketable skills. Rasiel said that a few years in banking gives Duke graduates access to opportunities in other industries and sets them up well for later ventures.

“The typical stereotype is to do it for money, but it’s more than that,” Lustig said. “You get to do something that’s well-regarded. You work with important people and important companies. It’s interesting. You learn something new every day.”

Prestige and competition

Another notable factor that draws students to the industry is its competitive and high-profile nature.

Financial companies that recruit on campus and pose challenging application processes carry prestige that naturally appeals to high-achieving students, said Michael Schoenfeld, vice president for public affairs and government relations.

“Students at places like Duke are highly competitive, and it is very competitive to get those jobs,” Schoenfeld said. “It makes sense that people who have been striving their entire lives decided to focus on competing for something that very few people can have.”

Senior Daniel Benzecry said he was drawn to the types of opportunities that financial jobs present.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.

“Being in New York in finance, you can’t go higher,” said Benzecry, who plans to work in sales and trading at Nomura Group in New York after graduation. “It’s the top of the world.”

This draw is not limited to finance. Schoenfeld cited the increasing popularity of Teach for America—a nonprofit organization that sends graduates into underperforming K-12 schools—as a direct result of this mindset. Since its founding in 1990, Teach for America has earned itself the reputation of an elite brand, receiving 48,000 applications last year with an acceptance rate of 11 percent. As more people apply, the process becomes more competitive and thus more appealing to certain students.

“TFA has become one of the most competitive recruiters nationally, so the chance to compete at a high level is... in line with the culture of our students,” said William Wright-Swadel, Fannie Mitchell executive director of the Duke Career Center, adding that both Teach for America and financial firms attract the same type of students.

The cycle continues

Loyal alumni who recruit at Duke create opportunities for current students to begin their careers. Because many Duke graduates work in finance, many of the available opportunities for seniors are in this industry, which in turn perpetuates a cycle.

“When you have more people in an industry, you build relations with that industry very quickly,” Wright-Swadel said. “And we have very strong champions—alumni who are in the industry—on Wall Street.”

John Caccavale, who previously served as captain of the Duke recruiting teams at J.P. Morgan and Barclays Capital, estimated that nearly all finance recruiting teams that come to campus include Duke alumni. Caccavale, Trinity ’81, has since returned to the University and now serves as executive director of the Duke University Financial Economics Center.

“We have such strong alumni connections,” Caccavale said. “[As a recruiter] I wanted to hire Duke students.”

Building a presence at a company can happen quickly. Four years ago, for example, the Citi transaction services department of Citigroup established Duke as one of the 10 core schools from which it recruits, said John Ladany, managing director in Citi Transaction Services, co-head of the Duke recruiting team and Trinity ’79. Since then, more than a dozen Duke students have been recruited to work in the department.

Some of Duke’s institutional tools may also play a role in urging students toward finance. For his honors thesis, senior Ryan Genkin analyzed more than 1,200 full-time job listings in Duke eRecruiting, a breakdown that is not made publicly available by the University. Genkin found that 25.6 percent of the job postings in the University’s premier job database were in the finance and insurance industry.

Whether or not Duke students will continue to pursue finance in the long term is unclear. New legislation, such as Dodd-Frank Wall Street Reform and Consumer Protection Act, may impact the industry and cause banks to hire fewer students, Rasiel noted.

But in the short term, Rasiel said that interest in finance is here to stay.

“As long as the banks are hiring, the students will want to go there,” she said.