What could Durham do with $50 million?

That was the question posed to nearly 100 Durham residents and community organizers gathered at a Duke Respect Durham kick-off event hosted Saturday at Asbury Methodist Church off of East Campus.

“Affordable housing,” “teacher pay” and “increased funding for public schools” were some of the ideas floated during the session.

The movement — dedicated to making “Duke pay their fair share” — calls on Duke to make voluntary payments in lieu of property taxes on all of its owned land to the City of Durham beginning in 2024, which it reports to be 11%.

The campaign has estimated that Duke would owe $50 million in property taxes if it was not tax-exempt. According to the most recent 2023 Annual Report on Engagement and Impact, the University reported paying $3.7 million in property taxes.

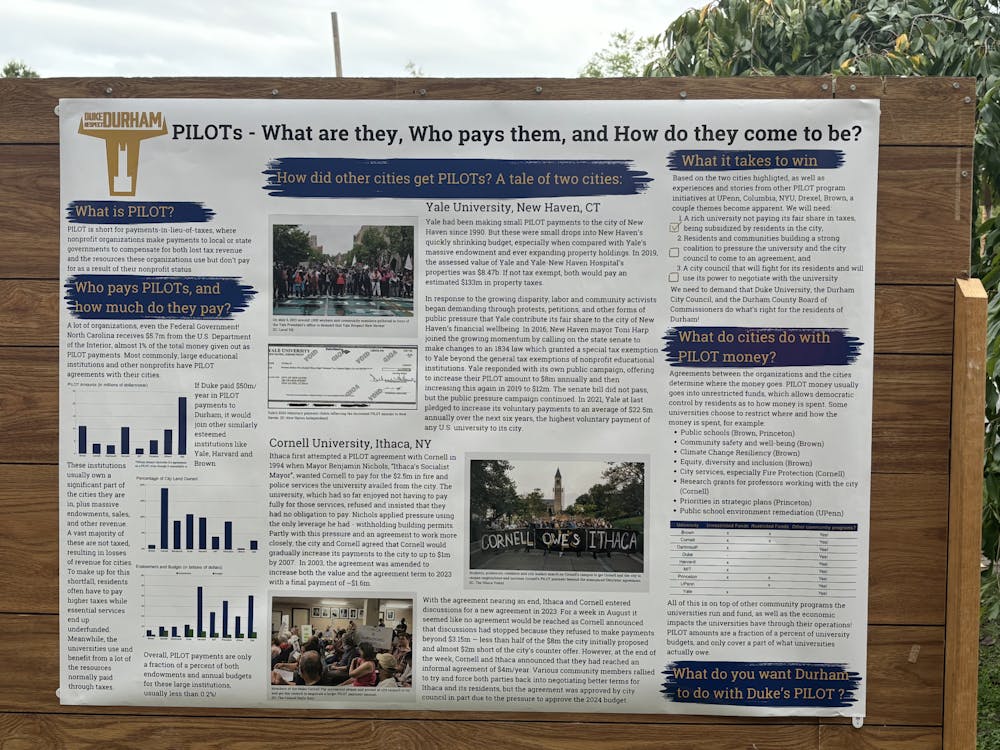

Duke University and the Duke Health System are currently classified as 501(c)(3) tax-exempt charitable nonprofits, meaning they are not required to pay property taxes on owned land that is not used for commercial purposes. Duke Respect Durham is asking Duke to pay “PILOTs,” or payments in lieu of taxes, to the city in order to offset the revenue lost by their tax-exempt status.

According to a Tuesday email to The Chronicle, Adam Klein, Duke associate vice president for economic development, shared that the University and Duke Health “own about 4.3% of the land of Durham County.” Half of it, he added, is Duke Forest, “which provides recreation and other benefits to the community and extends into Orange and Alamance counties.”

“Duke paid nearly $24 million directly to local government and nonprofit entities in Durham in 2023. That’s $9.7 million in property tax payments, both on non-academic Duke-owned properties and through rented property; $4 million in direct fire service and EMS payments; and more than $10 million invested in Durham-based organizations and nonprofits,” Klein added. “Duke spent $242 million with Durham-based businesses in 2023, and about 62% of Duke employees live in Durham — that’s 29,000 taxpayers also supporting the city and county and spending their money in Durham.”

The event, sponsored by 28 local organizations and featuring Durham City Council member Nate Baker, gathered the community in support for the budding coalition.

A number of Duke’s peer institutions — including Brown University, Cornell University, Harvard University and the University of Pennsylvania — pay PILOTs to the cities they are located in.

“Duke may provide benefits [to Durham]. But let's be honest — they do it on their terms. It's not a democratic relationship,” Baker said. “… Imagine if all of us did what Duke did and we just didn't pay our property tax, we just kind of contributed to different things that we thought were cool, and then we put our name on it.”

According to a poster displayed at the event, institutions typically “own a significant part of the cities they are in,” including endowments, sales and other revenue — a majority which are not taxed, which leads cities to lose revenue and increase residents’ taxes.

Members of the Durham community gave personal testimonies about how the city could benefit from receiving a PILOT payment from Duke.

Christy Patterson, vice president of the Durham Association of Educators and a public school teacher, shared that as a teacher, she has witnessed first hand the effects of an underfunded city.

“They are estimated to owe Durham $50 million a year if they’re fully taxed. We middle class citizens of this community are footing that bill.” Patterson said. “Just imagine what our public schools will look like if Duke paid their fair share.”

She identified funding for after-school programs, sufficient athletics equipment and top-of-the-line technology as some of the potential benefits of Duke paying PILOTs.

Durham County Commissioner Nida Allam explained that although the Durham County Commissioners passed a historically large budget for Durham Public Schools, it came at a 4.65-cent tax increase for residents.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.

“We need to bring Duke to the table so that they understand that our residents and our neighbors are stepping up to the plate and paying for these increases that we need, especially for our students [and] for our families,” she said.

Baker said he’d like to see Duke enter into a long-term contract with the city in order to pay its fair share. He said that Duke had built its nonprofit status on its hard workers — and if the University was going to tout its strong partnership with Durham and the local government, it must “[begin] to make reasonable payments to our local governments and to the collective good.”

“Duke, you hear me and you hear me loud and clear, you will pay,” Patterson told a cheering crowd. “It may not be tomorrow. It may not be next year. It may not be five years from now. But Duke, listen to me. You will pay. Because my students deserve it. Our children deserve it. Our children's children deserve it. These hard-working people who are bending over backwards deserve it, and you will pay.”

Claire Cranford is a Trinity sophomore and features managing editor for the news department.