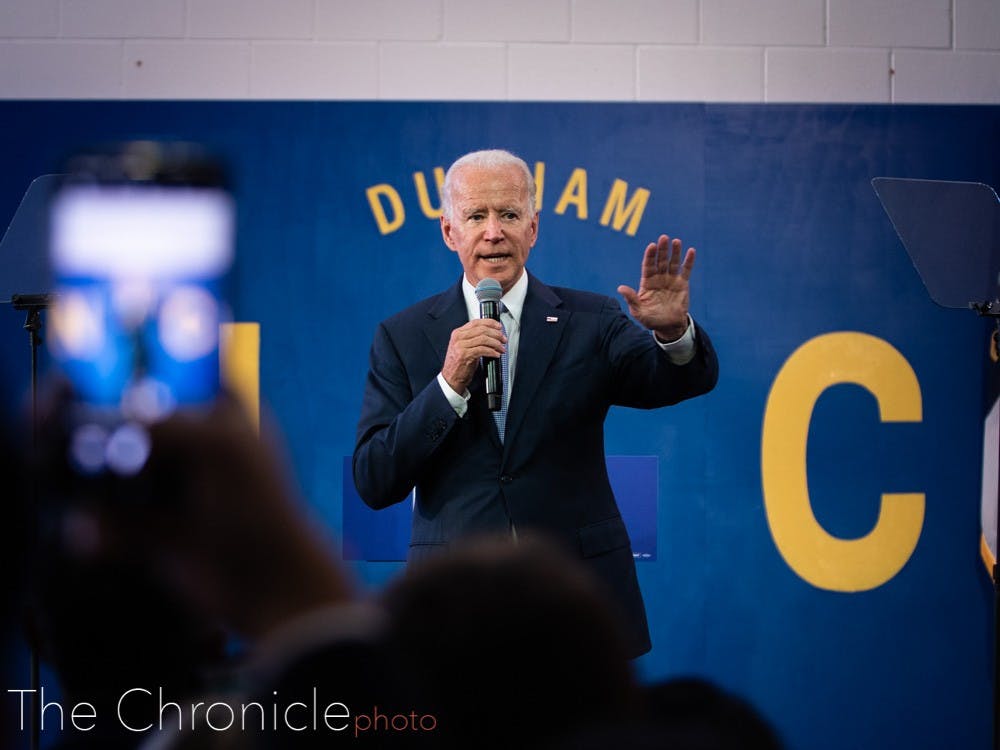

President Joseph Biden signed legislation on Saturday to lift the federal debt ceiling and impose limits on government spending until 2025, averting what would have been the nation's first-ever debt default. The law eliminates the possibility of further suspensions of mandatory student loan payments.

Former President Donald Trump implemented a pause in student loan payments in March 2020, originally set to lift in September 2020 as part of the CARES Act, a stimulus bill in response to the COVID-19 pandemic. Since then, Biden has issued several extensions pausing student loan payments, the most recent of which is set to expire 60 days after a Supreme Court decision challenging his student debt relief program. If litigation is not resolved and the program is not implemented by June 30, the suspension will end on Aug. 30.

The Fiscal Responsibility Act will eliminate the possibility of further suspending student loan payments.

However, Biden’s student loan relief plan remains viable despite new spending restrictions. The Fiscal Responsibility Act bars further pauses on student loan payments but does not inhibit Biden's student debt forgiveness plan.

In December, the Supreme Court agreed to hear arguments challenging Biden’s student loan relief program in Biden v. Nebraska. Since then, the program’s rollout has been blocked, and a decision is expected in June. If the Supreme Court rules in favor of Biden, over 40 million borrowers would be eligible for student loan forgiveness.

Under this relief plan, borrowers with an annual income below $125,000 will qualify for $10,000 of forgiven debt. Pell Grant recipients qualify for an additional $10,000.

On Wednesday, Biden vetoed a bill that would have repealed his student debt relief plan and ended the pause on loan payments.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.

Audrey Patterson is a Trinity sophomore and local and national news editor of The Chronicle's 119th volume.