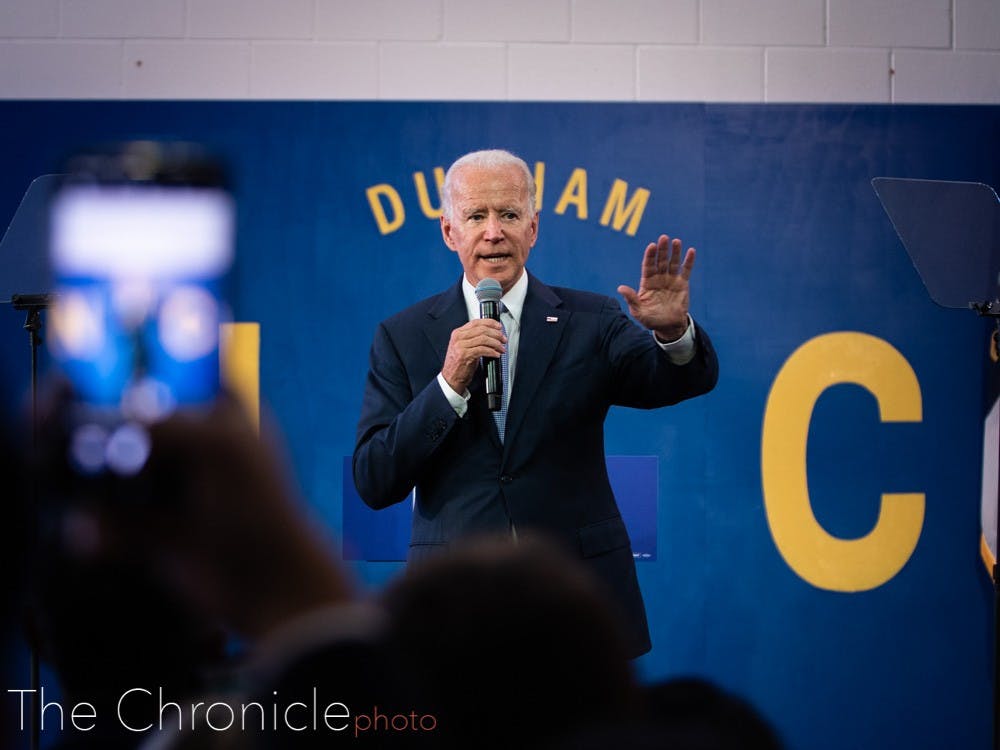

As the Supreme Court considers the legality of President Joe Biden’s student loan forgiveness plan in two separate cases, here’s how its outcomes could impact Duke students.

Originally announced last August, the student debt relief plan would cancel up to $10,000 in federal student loans for non-Pell grant recipients and $20,000 for Pell grant recipients. The plan is limited to individuals with incomes of less than $125,00 per year or married couples and household heads that make less than $250,000 per year.

Several states have challenged the plan on constitutional grounds, while another case challenged the plan on procedural grounds.

If the Supreme Court renders decisions in favor of the Biden administration, both students and alumni “could be eligible for a one-time forgiveness of debt,” wrote Miranda McCall, assistant vice provost and director of the Karsh Office of Undergraduate Financial Support, in an email to The Chronicle.

“Regardless of the Supreme Court decision, Duke will continue to advocate for improved terms and conditions for federal loans,” McCall wrote.

On average, Duke students graduate with a median debt of $13,500, which is below the national average, according to McCall. This decision could reduce a large portion of what students owe as 30% of Duke undergraduate students take out loans to graduate.

If decisions are rendered against the Biden administration, procedures regarding student loans will return to those in place before the plan was announced.

Nebraska, Missouri, Arkansas, Kansas, Iowa and South Carolina are at the helm of the primary case against the plan for one-time debt relief. Arguments against the forgiveness plan argue that it is not authorized by any congressional statute and that loan forgiveness will reduce state revenue, according to court transcripts of oral arguments.

Plaintiffs Myra Brown and Alexander Taylor in a second case, Department of Education v. Brown, have argued that the Biden administration did not follow proper procedures in creating the student loan forgiveness plan.

Brown and Taylor both allege that if proper procedure had been followed they would have been able to weigh in on the plan and encourage changes to it that would have been more beneficial to them. Brown is ineligible for loan forgiveness because her loans are held commercially, and Taylor is ineligible for the full $20,000 because he did not receive a Pell grant.

The Biden administration, however, feels that cases against loan forgiveness don’t have a strong foundation and that the Department of Education is exercising long-standing authority to protect borrowers during national emergencies.

“The Department of Justice argued against the lawsuits aimed at denying relief to borrowers, made clear that challengers to the program lack standing to even bring their cases to court, and explained the Department of Education’s decades-old authority used by multiple administrations to protect borrowers from the effects of national emergencies,” Secretary of Education Miguel Cardona said in a release.

Student loan payments are currently paused until the Supreme Court releases the decision. Payments will resume 60 days following the decision release date. If a decision is not made by June 30, payments will resume 60 days after that.

The Biden administration stated that it doesn’t have an alternative plan if the initiative is struck down.

The Supreme Court is expected to release its decision in June, at the end of its 2022-2023 term.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.