Ubers and shopping and Shooters, oh my!

The Chronicle conducted an informal survey of 57 participants, where students answered questions about their monthly personal spending, the source of their spending money and what they spent it on. The answers to these questions varied widely.

Even before considering personal expenses, the total cost of attendance for Duke for the 2020-21 academic year will be $76,270. To compare, the median family income of Duke students is more than $186,000, according to The New York Times.

Although 70% of students come from the top 20% income bracket, 52% of Duke students still receive some form of financial aid. There are also need-based merit scholarships like the David M. Rubenstein Scholars Program, which fully funds a four-year Duke education for “exceptional, first-generation, low-income students,” according to the Rubenstein Scholars website.

When determining the amount of aid to provide, Duke’s financial aid office estimates that students will spend an average of $2,206 per year on personal expenses, such as “spending money and other costs that students may want to consider when arriving on campus,” according to the website.

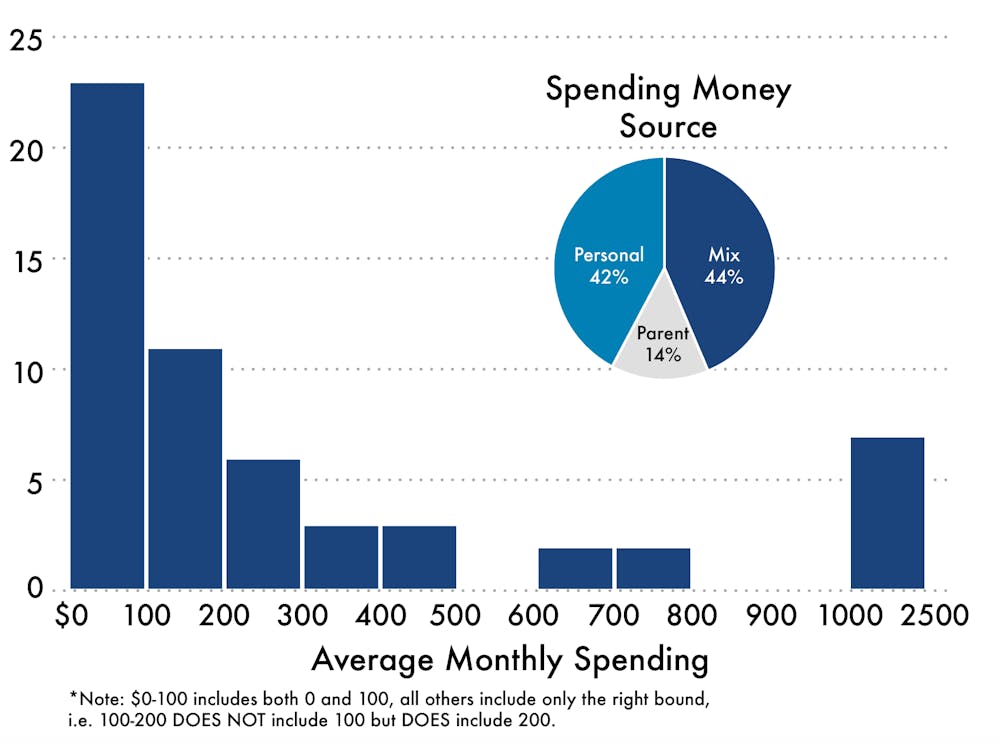

The survey asked students to state how much they spend, on average, “in disposable expenses during one month at Duke.” This excludes any costs included in tuition, such as food points. The survey may be subject to bias because students elected to respond and self-reported numbers.

The survey responses ranged from $0 to $2500 per month, with most falling in the $20-$500 range. About 42% of students paid for their spending using personal income, 14% used parent income and 44% used a mix of both personal and parent income. In general, students who spent less often used personal income, whereas those who spent more often used a mix of parent and personal income.

The Chronicle also spoke with some students to dive deeper into their spending habits. Most students indicated that they spend most of their money on basic necessities like toiletries or school supplies, and both the survey and interview responses revealed the most common reasons for personal spending is off-campus meals, ride-booking services like Uber, groceries and toiletries.

Sophomore Maddie Paris, who spends an average of $25 per month, wrote in an email that she typically never buys anything unless she needs it. She never spends money going to Shooters, shopping for clothes online or paying for an Uber on her own.

Most students attributed their spending habits to personal choices. The majority valued frugality, even if their families' financial backgrounds would have allowed for more generous spending.

Junior Adam Snowden, for example, explained that he has always tended to live under his means. Although he said he is fortunate to come from a financially stable family, he said it is his “personal choice” to be very frugal, spending only on basic necessities, which he was taught from a young age.

Balancing work and play

Students The Chronicle spoke to also made sure to budget for fun, many of them working one or multiple on-campus jobs to help pay for activities like off-campus meals, ride-booking services, entry to bars and beach week. Students tended to be quite selective and intentional about what type of “fun” they chose to spend on, however.

Snowden noted that he has been able to balance being social and living frugally. He finds that people are often understanding when he asks to do a less-expensive activity or choose a less-expensive restaurant.

He said he also saves money throughout the year for beach week because it’s something he enjoys, and he will allocate money for opportunities unique to Duke. For example, he wouldn’t spend money to see a movie, but he would buy a ticket for a Hoof ‘n’ Horn show because his friends are in it.

Sophomore JJ Jiang, who spends around $125 per month, wrote in an email that since all her spending comes from personal income, she works two jobs on campus and has a stipend-based fellowship. About three-quarters of the money she makes goes toward savings or tuition, which allows her to feel more comfortable spending money.

She noted that she keeps careful track of all her spending through a separate app that categorizes how much she spends and on what.

“I try to prioritize spending on experiences, especially with other people, rather than material items, since having those memories to look back on and moments with friends is important to me,” Jiang wrote in an email.

Even so, students limit off-campus meals to special occasions or once-in-a-while treats for the most part, preferring to rely on their prepaid food points when the option is available.

“I would feel guilty going off campus to eat and would much rather use food points on campus,” said sophomore Evelyn Sturrock, who spends about $100 per month. However, she noted that she would like to spend more on the Durham restaurant scene if money were not a concern.

Plenty to do on campus

Junior Samuel Rabinowitz said he spends roughly $7 every two weeks on things like splitting an Uber ride, getting an off-campus meal or paying for entry to a club. Although he is conscious about everything he spends, Rabinowitz said he doesn’t feel limited in his spending because there are always food points and free events to take advantage of on campus.

“There's nothing really motivating me to spend money when there's so many options that don't require it,” he said. “I think that's very much because I have so much provided by Duke. Here, there's so many things that are just free for leisure. They have screenings for movies that are free all the time. There's so much you can do that doesn't require much money.”

Even in a friend group that may like to go out a lot, he said that there are still on-campus options that are almost like going out, such as free movie screenings by Duke University Union's Freewater Presentations and parties held by social groups that don’t require an entry fee.

Feeling left out

Snowden said that at Duke, it’s easy to be surrounded by people who are more comfortable spending money and to feel almost “left out” if you don’t want to spend as much.

One thing that he said he feels a little left out from, he said, is the fall break, spring break and summer trips that others go on. However, Snowden acknowledged that his spending habits are purely a “personal decision.” It would be different, and maybe even slightly alienating, had he come from a more economically disadvantaged background, he said.

Paris echoed similar sentiments that spending could be a much more difficult issue for less-affluent students, such as the stress and worry of balancing money with costly social activities.

Although The Chronicle was not able to reach any students who identified themselves as low-income, one survey respondent who spends roughly $30 per month wrote in the survey, “I’m poor. Not supported by my parents. On full financial aid. Duke provides me with all my basic necessities.”

Budgeting for the future

In terms of budgeting, many students have organized personal financial plans in place.

Sturrock, for example, has a fairly regular work schedule and consistent pay per month that allow her to budget in advance. That usually means putting at least half of her paycheck into savings and the remainder into car insurance, gas and other necessary expenses.

Other students also have the future in mind when it comes to spending. For example, Paris thinks especially of her early post-college years.

“I’m trying to save as much as possible by the time I graduate so I have some place to start,” she wrote in an email. “My parents would help me get settled right out of college, but I’d like to start out on my own.”

Rabinowitz also noted that he spends frugally and works various jobs on campus so he can save up for after college as a “buffer” before getting a job.

Snowden shared that thoughts about his future also play a role in shaping his spending habits today. Regardless of his financial situation, he knows he wants to help provide for his family.

“Now, I want to live as far below by any means possible versus when I'm older and maybe have medical needs, have kids and their needs, and I have to provide for them,” he explained. “I think a large part of that is reflecting on that and trying to prepare myself far for the future.”

Correction: A previous version of this article incorrectly stated that Maddie Paris is a junior, and it has been updated to reflect that she is a sophomore. A previous photo caption incorrectly referred to average weekly spending, and the caption has been updated to refer to average monthly spending. The Chronicle regrets the errors.

This article is part of the wealth gap series. We are exploring how wealth impacts the student experience. Read about the project and explore the rest of the series.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.

Mona Tong is a Trinity senior and director of diversity, equity and inclusion analytics for The Chronicle's 117th volume. She was previously news editor for Volume 116.