The 2008 financial crisis might help explain President Donald Trump’s rise to the presidency, but not how many people would expect.

Peter Wallison, a lawyer and the Arthur F. Burns fellow in financial policy studies at the American Enterprise Institute, argued that the financial crisis can be attributed to government housing policies. At a Duke Law School event Tuesday, Wallison said the explanation conflicted with the prevailing diagnosis that the financial crisis was caused by a failure of government agencies to effectively regulate financial markets.

“You have to realize that the diagnosis protected a number of people,” said Wallison, who was also White House counsel for President Ronald Reagan. “No one wanted to investigate the housing policies.”

Wallison said he was critical of former Treasury Secretary Henry Paulson’s 2008 policy to bail out Bear Stearns while subsequently allowing the Lehman Brothers to file for bankruptcy. He mentioned that the Lehman Brothers' failure came as an “incredible shock” to creditors, who did not think very large institutions would be allowed to fail.

“All of these people who thought they knew what the world looked like in front of them were wrong, and that’s why we had an enormous crisis at that point,” Wallison said.

The dissent of the Financial Crisis Inquiry Commission’s report, which Wallison authored, explored the alternate theory that the government’s housing policies caused the financial crisis. He mentioned that the decline of the mortgage-backed securities market can be attributed to harmful policies during the Bill Clinton and George W. Bush administrations. The government was offering housing financing programs without adequate standards and safeguards, he said.

And by focusing on the wrong causes, Wallison said the government ended up passing misguided legislation that made matters worse.

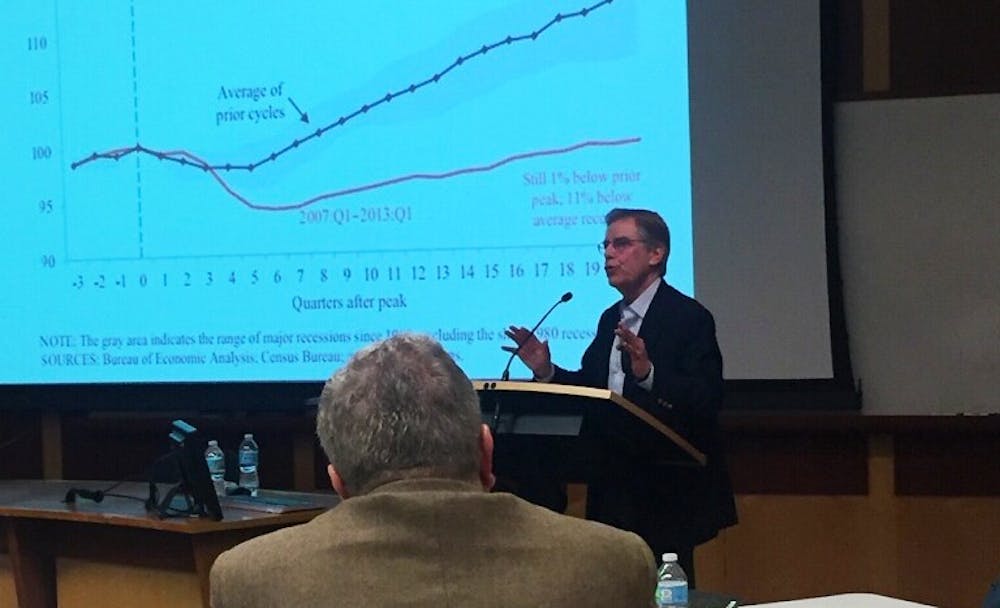

Wallison called Dodd-Frank—the Wall Street regulatory reforms passed after the financial crisis—the “most restrictive legislation on the financial system since the New Deal.” He said the adverse consequences of Dodd-Frank on economic growth—including less credit available to businesses and new regulations stifling risk-taking—can explain Trump’s victory.

“The standard diagnosis of what happened in 2016 is that many people in the United States—not on the two coasts—are feeling the pinch of the fact that economic growth is not occurring, that good jobs are not available,” Wallison said. “There’s a lot of malaise and anger, and that could have likely been the reason for the election of Donald Trump, a very unusual candidate, in 2016.”

He added that the discussion of Trump’s rise is linked to the false diagnosis of the financial crisis’ roots because it came from stifled economic growth that was a result of a misguided policy response to the crisis.

Following the talk, some audience members challenged Wallison's portrayal of the nation’s stifled economic growth, particularly in reference to the unemployment data he presented.

Holt Baker, a J.D. candidate at the Duke Law School, asked whether Wallison’s assessment of the policies that apply to the mortgage securities market had any link to student loans. In response, Wallison linked student lending practices to the risks taken in the mortgage securities market, noting that it has become easier to borrow to finance college costs.

Wallison concluded his talk by explaining why investigations that look at the causes of the financial crisis are relevant for future research.

"Not only did the diagnosis of the crisis produce a law that stifled economic growth in this country—it had political consequences—but it also created the possibility of yet more crises in the future because it set up exactly the kinds of mechanisms that would cause a crisis," he said.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.