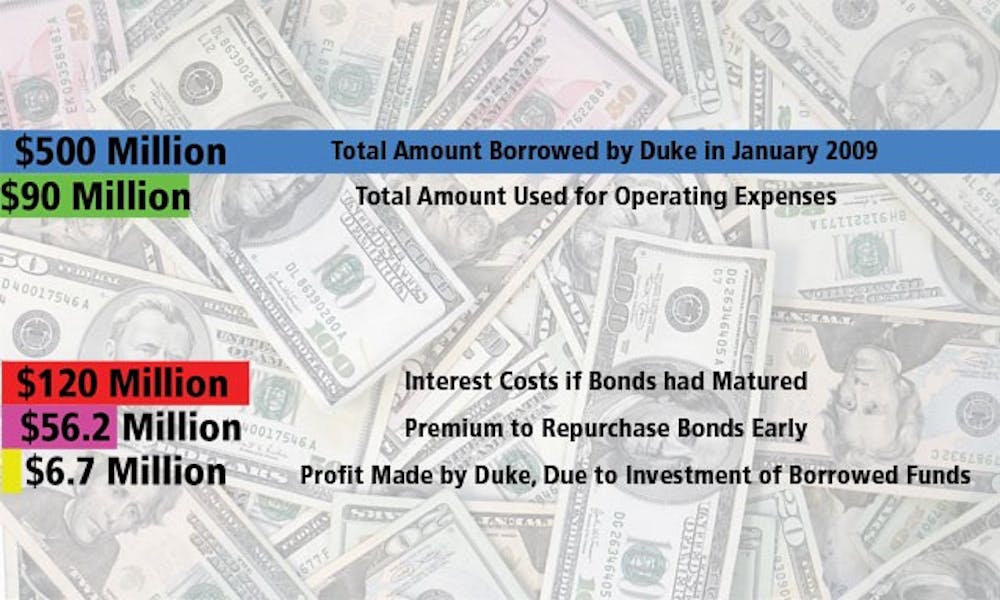

Earlier this month, the University repurchased all of the $500 million of debt it issued during the financial crisis, a tangible display of Duke’s increased confidence in its finances.

The May 5 move demonstrates that liquidity, or the ability to turn investments into cash quickly, is no longer as pressing a concern for Duke as it was at the height of the economic downturn in 2008. The University issued bonds in Jan. 2009 to ensure that it would not have to sell damaged, hard-to-move assets to cover its operating expenses like the payroll, said Executive Vice President Tallman Trask.

The University used $90 million of the funds raised from issuing the bonds to cover its operating expenses for the first quarter of 2010, Trask said. Typically, Duke uses a payout from its endowment to cover part of those expenses, but the economic climate made it difficult to sell investments to raise the money.

“This had served its purpose—I was no longer worried about the liquidity issue,” Trask said. “I’m confident now that if we had to go to the market now to get money, we could do that.”

Borrowing the $500 million did not cost the University anything because Duke invested the remaining $410 million it did not use for operating expenses in low-risk corporate securities, which earned more than enough to cover the 4.7 percent annual interest on the bonds, Trask said.

The University made $6.7 million on the transaction, even after paying a premium of $56.2 million to investors for the right to buy back the bonds early before they expired in 2014 and 2019, he said. Duke also avoided $120 million in interest payments it would otherwise have had to make on the money between now and 2019.

Trask said the bonds gave the University access to money for expenses if the need arose. He added that repurchasing the debt early relieved Duke from having to hope that the returns on the corporate securities continued to pay for the interest.

Although administrators noted that it was fortunate the transaction paid for itself, the issuing of bonds was never a money-making venture. Tim Walsh, who became vice president for finance in April after serving five months in the position on an interim basis, was involved in the discussions concerning the repurchase of the bonds. He noted that the move was purely a “defensive maneuver.”

Duke is a nonprofit institution and therefore it has access to nontaxable bonds, which allows borrowing at a low interest rate. In return for these terms, however, the University is prohibited from borrowing funds with the intent to invest them for a profit, Walsh said. In this case, the University chose to issue taxable bonds as any corporation would, a move more appropriate for this “liquidity backdrop,” he said.

“Tax exempt organizations can get into trouble if they try to profit from something like this, and that was not our intention at all,” Walsh said. “We should not take advantage of our preferred access to the debt market to make money. In fact, we don’t even want to risk the perception that we had taken advantage of our status to make a profit, even though these were taxable bonds.”

The conversation about whether to buy back the debt began in the Fall, Walsh said. Given the current economic conditions in which interest rates on new debt are very low, it no longer made sense to keep the debt, he added.

Similar to the college student who makes prompt credit card payments to build credit, the move also shows Duke’s ability to repay its debt. Moving forward, Duke is more attractive to potential bondholders because it performed well, Trask said.

In order to avoid conflicts of interest in such a large financial deal, Trask noted that Duke officials close to the decision-making process were careful to keep the transaction’s timing confidential. Only the members of the Board of Trustees immediately involved in the decision—Susan Stalnecker, Trinity ’73, and Bruce Karsh, Trinity ’77—were aware of the timing, he said.

“To my knowledge, no Trustees had any financial interest in this transaction,” Trask said, adding that though the bonds are publicly traded securities, any Trustee with a financial stake in the deal would be required to report it. “I can assure you that with the exception of [Karsh and Stalnecker]—who I know had no interest—the other Trustees didn’t know the timing, didn’t know the details. We were very careful on that.”

Between December 2008 and November 2009, at least 15 universities, including six Ivy League Schools, issued $7.2 billion of taxable bonds, Bloomberg reported. Harvard University announced in April that it will repurchase $300 million of the $1.5 billion of taxable bonds it issued during the downturn, but Trask noted that Duke is the first university to buy back its debt from the financial crisis, as Harvard will repurchase its bonds June 2.

“It strengthens us to have less debt, and I think it sends an important message that we were able to pay it off,” Trask said.

Get The Chronicle straight to your inbox

Signup for our weekly newsletter. Cancel at any time.