In December 1924, James B. Duke established the Charlotte-based Duke Endowment with a gift of $40 million. Of the original donation, $6 million went to Trinity College, which became Duke University, and the remaining money was invested, with its income awarded to educational, health care, religious and child care organizations in North and South Carolina. Now, more than 80 years and $2 billion in grants later, the Duke Endowment has not been able to escape the turbulent economy unscathed.

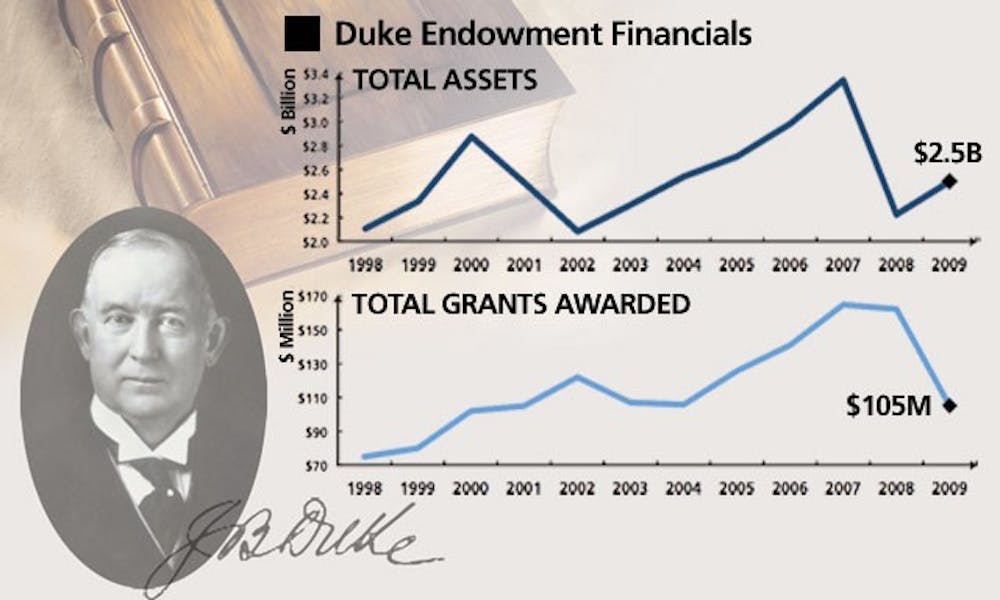

The Duke Endowment pledged almost $57 million in 185 new grants to North and South Carolina institutions in 2009. Along with money allocated to continuing multi-year projects, the foundation distributed about $105 million last year.

The total amount awarded in 2009, including money donated for both new grants and ongoing projects, dropped about $57 million from the $162 million given in 2008, said Jeri Krentz, assistant director of communications for the Duke Endowment. In addition, the 2009 figure for new grants decreased approximately $148 million from 2008, when the Duke Endowment pledged about $204.5 million for 410 new commitments.

Although the Duke Endowment is the University’s single largest donor—about one-third of the Endowment’s yearly giving goes to Duke—the foundation is independent of the University.

The decreased giving in 2009 was due to a combination of the foundation’s investment losses and several large ongoing commitments from 2008, said Duke Endowment President Eugene Cochrane.

“The most important thing we did, I think, was to honor the commitments we already had in place,” he said. “So if we had committed to an organization that we would pay them in 2009 and 2010, we honor those commitments before we take new requests. That’s why you see the number of new grants drop so much, is that we’re honoring previous commitments.”

In addition, certain program areas that had substantial new grants in 2008—such as child care and health care—were not allotted as much funding in 2009, Cochrane said.

Some of the continuing projects from 2008 include a $50 million gift to Duke University Health System for the creation of a pediatric inpatient facility and medical learning center, $14 million to Furman University to sponsor a new scholarship program and $10 million to Duke in support of Perkins Library.

Funds for continuing projects are distributed over several years, but the total amount is reported in the original year’s new grants total, said Charity Perkins, director of communications for the Duke Endowment. Thus, the reported amount of new grants usually differs greatly from the actual amount of money distributed by the Duke Endowment each year, she added.

Diminished assets

The reduction in new commitments, however, cannot be completely attributed to the large projects undertaken in previous years. Cochrane said a large drop in assets also caused Duke Endowment officials to be more selective when considering grant applicants.

Currently, the organization’s assets are worth around $2.5 billion, a slight increase from the low of $2.2 billion reported in March 2009, but nowhere close to its record high in November 2007 of $3.3 billion, Cochrane said.

“When you have that much of an asset drop, your giving has to drop,” he said.

The foundation’s investments are managed by the Duke University Management Company, which also handles the University’s endowment.

This is the first time the Duke Endowment has been severely affected by a recession since its inception 86 years ago.

The foundation’s investment strategy protected it from previous economic slowdowns, said Duke Endowment Chair Russell Robinson, Trinity ’54 and Law ’56.

Until a 1972 court order allowed other investments, Robinson noted, the Duke Endowment could only invest in the Duke Power Company, whose stock value was not affected significantly by the numerous financial turmoils of the last century. Even after 1972, the Duke Endowment did not begin investing substantially in other companies until after 1993, allowing the foundation to remain relatively unharmed in the 1987 stock market crash and the resulting recession, Robinson explained.

But the recession of this century, unlike the last, has affected the Duke Endowment’s broader investments during the last few years. Robinson said that because a majority of the foundation’s investments are private, they lack readily available market value information.

The diminished assets will continue to affect giving in 2010, and likely into 2011, he added.

“It makes it difficult for us to take on new beneficiaries and difficult to take on new projects even from beneficiaries that we have traditionally supported,” Robinson said.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.

Giving to Duke

According to the Duke Endowment’s indenture, the foundation must donate 32 percent of its yearly giving to Duke University, 32 percent to health care organizations, 12 percent to support rural churches, 10 percent to child care organizations, 5 percent to Davidson College, 5 percent to Furman University in South Carolina and 4 percent to Johnson C. Smith University in Charlotte. These figures, however, are just “target” donations and the Endowment does not precisely meet the stated distributions every year, Cochrane said.

The Duke Endowment, in addition to being Duke’s most generous benefactor, donates more to the University than its indenture indicates, said William Conescu, executive director of Alumni and Development Communications for the University.

Last year, the Duke Endowment pledged about $18 million in new grants to the University, down from the foundation’s promise of almost $85 million in 2008. The figures were calculated based on data available on the Duke Endowment’s Web site.

The largest donations in 2009 include an almost $2 million gift to the Center for Child & Family Policy and $1 million to the Sanford School of Public Policy. The Duke Endowment has also awarded $12.5 million to the University for unrestricted operating costs every year since at least 2007, according to the organization’s Web site.