Proposed tax cuts at the federal level could have financial consequences for graduate students at Duke.

Released Nov. 2, the House of Representatives version of the Tax Cuts and Jobs Act of 2017 eliminates tax deductions for student loan interest and two educational tax credits–the Lifetime Learning Credit and the Hope Scholarship Credit. It also places a 1.4 percent excise tax on endowments that are valued at $100,000 per student and universities that have at least 500 students. Additionally, the legislation eliminates an IRS exemption for graduate students that previously enabled them to not have to pay taxes on tuition waivers.

The Senate Finance Committee proposed its version of the act Thursday. Unlike the House version, it maintains both student loan interest deductions and the three educational tax credits, not requiring graduate students to pay taxes on tuition revisions. Although the bill still places an excise tax on endowments, a private college’s assets must be valued at or above $250,000 per student–instead of $100,000.

Michael Schoenfeld, vice president of public affairs and government relations, wrote in an email that he was concerned about the impact of the tax legislation on students.

“These bills...take aim at colleges and college students with a number of punitive measures that have the general impact of taking opportunities away from students, by taxing endowments and other important sources of scholarships and financial aid, eliminating the special tax treatment for employer provided educational benefits, and making graduate school tuition waivers taxable,” Schoenfeld wrote.

In the past, private nonprofit colleges' assets have not been taxed because of their non-profit status. Both versions of the GOP tax plan aim to reverse this status quo.

Will Barclay, graduate and professional student council director of advocacy, emphasized that graduate students are reacting “very badly as a whole” to the House bill.

“At first I received several e-mails from a lot of students asking what our plan is as far as our advocacy team platform," Barclay said. "I can say from the numbers released, pretty much all of the fears that the students have exhibited are well-founded."

GPSC President Rashmi Joglekar—a Ph.D. candidate at the Nicholas School—described the “overall sentiment” of graduate students as one of “apprehension.” When considering the “significant differences” between the House and Senate bills—and the student loan interest deductions and tuition revisions—Joglekar concurred that the House bill would pose a greater risk to the financial feasibility of graduate school.

“The biggest blockade is getting people in the door,” Joglekar said.

Student loan interest deduction

Even though Barclay said the student loan interest deduction is a good use of federal dollars, he did not agree that eliminating the deduction in the name of comprehensive tax reform, proposed by the GOP, is justified.

“The stated rationale for this tax reform is to benefit middle and low-income families. With regard to student loans, the individuals who end up taking the most loan burden are those from the low-income families,” Barclay said. “So, anything that impairs their ability to repay their loans is counterproductive because those who issue the loans—including the federal government—won’t be repaid by them sufficiently or at all.”

Barclay said that the House bill would “definitely affect enrollment,” as students of low-income backgrounds would have fewer means to meet the additional financial strain. Joglekar concurred that low-income groups will “absolutely be affected” by House's version of the tax bill.

“[The House bill] definitely will select for individuals who were personally wealthy before coming to graduate school because they are the ones who can afford the higher tax rates,” Barclay said. “It would bias entry against low income students. That is probably pretty certain.”

Tuition as taxable income

Currently, graduate students are taxed an amount equivalent to their stipends. At private colleges, stipends are valued at an amount less than tuition. Thus, Joglekar noted the implications of the House bill classifying waived tuition as taxable income.

“[Graduate students] will be jumping more than two income brackets,” Joglekar said.

The revised tax code, according to the House legislation, would make tuition deductions count as taxable income, affecting all graduate students with a fellowship, scholarship, receiving financial aid or any kind of tuition reduction.

Barclay noted this is the most important part of the reform, especially because of its impact on faculty. He detailed that the programs from which they receive scholarships and other forms of funding would be negatively affected.

Get The Chronicle straight to your inbox

Sign up for our weekly newsletter. Cancel at any time.

Stepping outside of his role of advocacy director and into the shoes of a graduate student in the immunology department, Barclay said he found it personally troubling that 60 percent of the students affected by this reform are in science, technology, engineering and mathematics fields.

“We would never see a dime of that money. That is very simple and straightforward. Suffice it to say that it would be pretty devastating,” Barclay said.

Moving forward

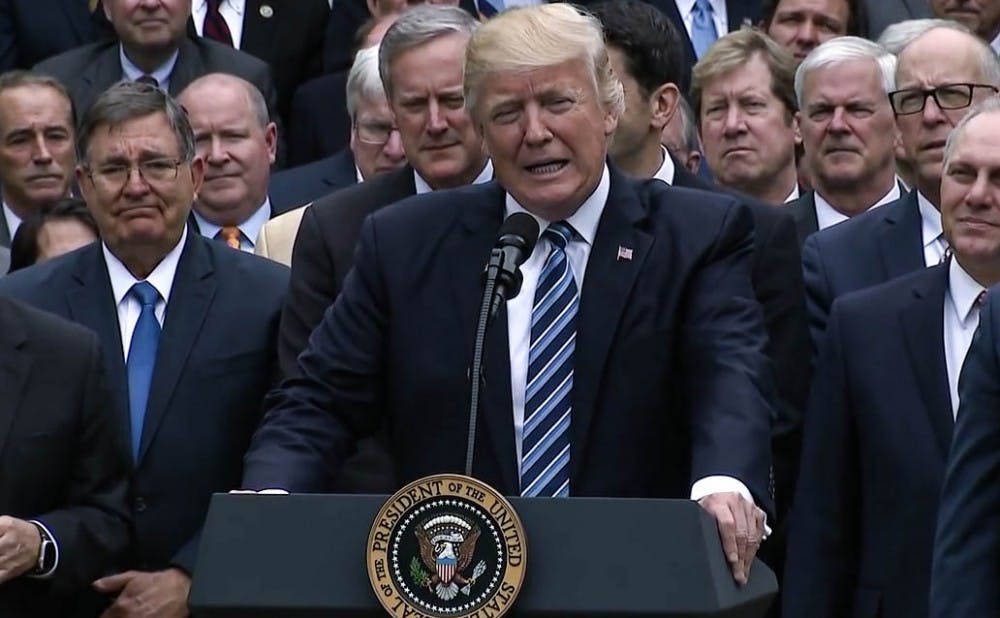

This past Thursday, members in the Ways and Means Committee voted along party lines to advance the tax reform bill to the House floor. The Senate does not have a formal schedule for voting on its version.

Joglekar remarked that she does not envision any benefits for graduate students under the House bill.

“In fact, no one in higher education will benefit,” Joglekar said.

Stefanie Pousoulides is The Chronicle's Investigations Editor. A senior from Akron, Ohio, Stefanie is double majoring in political science and international comparative studies and serves as a Senior Editor of The Muse Magazine, Duke's feminist magazine. She is also a former co-Editor-in-Chief of The Muse Magazine and a former reporting intern at PolitiFact in Washington, D.C.